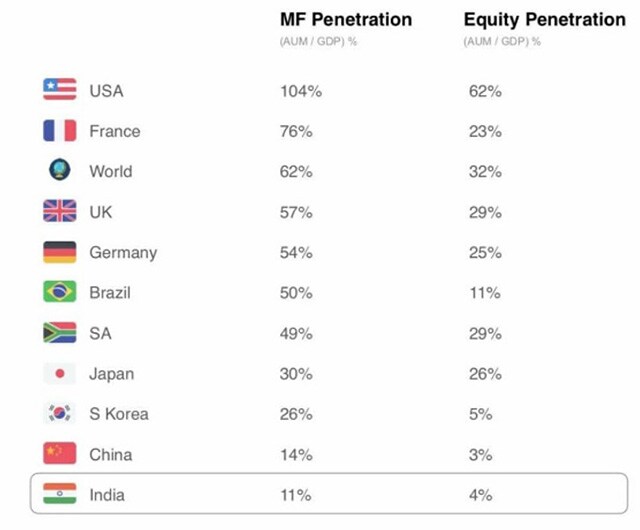

The above chart is always intriguing, how Brazil has different levels of Mutual Fund (MF) penetration although it is part of the emerging market or has a developing country tag!

The global trade and economic landscape has been changing, especially in the aftermath of the COVID-19 pandemic. Countries that were relevant in the past in terms of their dominance over global trade are now losing their stronghold. This trend was primarily precipitated by the 2008 Global Financial Crisis (GFC), a time when India and Brazil became entwined through BRICS – a group of emerging countries that found their place on the global economic map. This was an important grouping as it put together the leading emerging economies of the world comprising a little over 40 per cent of the global population and cornering around 20 per cent of global GDP.

At the time, these countries were poised for exponential growth and well-positioned to disrupt the prevailing world order. However, today, both Russia and China, due to factors specific to each country, seem to have taken a backseat. Both Brazil and India – what makes us the same and what differentiates us. A deeper look at the relevant data revealed some interesting facts. For example, mutual fund penetration in India is around 11.8 per cent which is significantly lower compared to Brazil where it is at approximately 50 per cent. From that perspective, the chasm is wide. However, when it comes to equity penetration it’s in similar range, India at 4 per cent and Brazil equity penetration of equity stands at 11 per cent.

Caminho das Índias (India: A Love Story), Brazil’s number 1 telenovela (Tele-series) in the year 2009, made it impossible for Brazilians to ignore India. Suddenly, ‘everybody’ or almost everybody in Brazil wanted to be like the Indians. With ‘achcha’ instead of ‘OK’ becoming cool, and Indian clothes, jewellery, and Indian food becoming a fad, it seemed like the start of a long-term relationship between India and Brazil. Interestingly, not just a year before, in 2008, the now defunct Orkut became one of the most visited websites in India and Brazil.

Two peas in a pod or two different pods

The similarities between Brazil and India are indeed striking. They are both influential global economies, act as functioning and mature democracies, have a free media and a vibrant society. Correspondingly, many of the challenges they face are also similar ranging from political thoughts with different ideologies and glaring income and regional inequalities and skyscrapers of affluence. Like Mumbai’s Dharavi, Rio-de-Janeiro has Rocinha they call it “Favela”. There are many socio-cultural parallels to be drawn as well, ranging from a shared love for food, music and celebration to similar familial values.

With so many similarities, one might also draw the conclusion that the savings and investing habits of Brazilians and Indians might mirror each other. However, there is a different telenovela brewing here. Case in point being the mutual fund penetration in the two countries. Currently, the assets under management (AUM) held by the mutual fund industry are just 12 per cent of India’s GDP , whereas Brazil sits next to Developed Market in term of penetration of MF with 68 per cent of their GDP, even higher than a global average of 63 per cent. From that perspective, it might be value accretive to identify the factors that contribute to the low penetration of mutual funds in India, compared to Brazil.

- Growth of B-15 / B-30 cities is picking up due to effort of industry, but lot to cover in absolute terms. This could primarily be attributed to the low levels of financial literacy and more to do with cultural attitudes towards savings and investments.

- Pre-covid times -low supply of mutual funds from AMCs outside the major cities with brick mortar model can be one reason and now with Digital evolution happening across all length and breadth of BFSI sector, surely this will change for MF and growth can be faster in smaller cities and towns.

Interestingly, both the countries started their mutual fund journeys at around the same time. The first mutual fund, called “Fundo Crescinco”, was created in Brazil in 1957, and until 1970, there existed only 11 funds in the country. India embarked on this journey in 1964 with the launch of the Unit Trust of India mutual fund scheme. While the head start was meagre in terms of the number of years, Brazil had already leapfrogged the innovation curve.

In the 1990s, several new types of equity and debt mutual funds were launched in Brazil, primarily in an attempt to stem the Weimar Republic style hyperinflation that Brazil was witnessing at the time. On the fixed income side, there were funds that could benefit from stock market upside via call options, invest in credit rights, etc. On the equity side, there was even a fund with the sole purpose of investing in private equity. The innovation journey for the Indian mutual fund industry, although remarkable, should act as impetus for faster growth. In India, growth of AIF as an Asset management Platform can be attributed to the new innovative offering like access to Private Equity and Private Debt market.

Investment habits of the population in the two countries

Brazilians have shown a higher proclivity for financial products when choosing optimal investment products. In 2002, stocks, private securities, and mutual funds occupied a larger share of investors’ portfolios while savings accounts lost ground for the first time in four years. Among Brazilians who invested in 2020, 53 per cent put their money into financial products. For the first time, financial products surpassed the sum of all other destinations for people’s surplus cash, reaching an estimated population of 20 million Brazilians (not comparable to us; UP as state has more population) which was enabled by the use of technology and increase in ease of banking.

In India, bank deposits, insurance funds, and provident and pension funds accounted for approximately 67 per cent of the financial assets of Indian households as of December 31, 2020, according to data released by the Reserve Bank of India (RBI). Mutual fund investments formed just 9.4% of an Indian household’s savings in financial assets. However, the appetite for financial investments has been increasing over the last two years and now with 10 crores + Demat accounts it’s catching up fast, partly precipitated by digitisation and the interest being generated in the 20-40s age group has been showing interest in Stock market and also MFs.

Drivers and constraints in the penetration of MFs in both countries

India is a land of diversity and interesting opportunities. It remains on the list of one of the most favoured investment destinations by international investors and businesses. It has a vibrant economy, a thriving entrepreneurial ecosystem, and an enabling regulatory environment – a combination of factors that will drive its growth in the decades to come. In the backdrop of such a landscape, inevitably, the larger part of the population gravitates faster towards financial assets, especially mutual funds – the simplest way to participate in the creation of wealth.

Over the past few years, the asset management industry in India has evolved significantly. Individual investors have grown significantly and command nearly 55 per cent of the AuM. Equity as an asset class has grown in prominence and now accounts for nearly 50 per cent of the AuM as against 23 per cent a few years ago.

A large share of this shift has been driven by increasing penetration across B15 cities that now account for nearly a quarter of the AUM. Correspondingly, channel structures have evolved—while intermediaries continue to hold sway, alternate channels like digital are increasingly being leveraged, especially during the discovery or exploration phase. The mutual fund industry can play a catalytic role in the India growth story as it makes financial investments easy and accessible to all segments of the population pyramid.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

The author is CBO, JM Financial Asset Management. Views expressed in the above piece are personal and solely that of the author. They do not necessarily reflect Firstpost’s views.

Read all the Latest News, Trending News, Cricket News, Bollywood News,

India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

1 year ago

216

1 year ago

216

English (US)

English (US)