The European Central Bank is widely expected to announce yet another interest rate cut on Thursday, in what would be the fifth reduction since the central bank began easing monetary policy in June last year.

Markets were last pricing in an over 90% chance of a 25-basis-point cut on Thursday, which would bring the ECB's deposit facility, its key rate, to 2.75%. Further rate cuts are then being priced in as the year continues, which would bring the deposit facility to 2% by the end of 2025, if they materialize.

The ECB is grappling with balancing a re-acceleration of euro area inflation in recent months with sluggish economic growth in the region. Headline euro are inflation rose for the third consecutive month to 2.4% in December, after falling below the ECB's 2% target several months earlier. A renewed pick-up in inflation was expected, as base effects from lower energy prices fade.

A first reading of the euro area's gross domestic product for the fourth quarter of 2024 is due out on Thursday, with economists polled by Reuters anticipating 0.1% growth from the previous period.

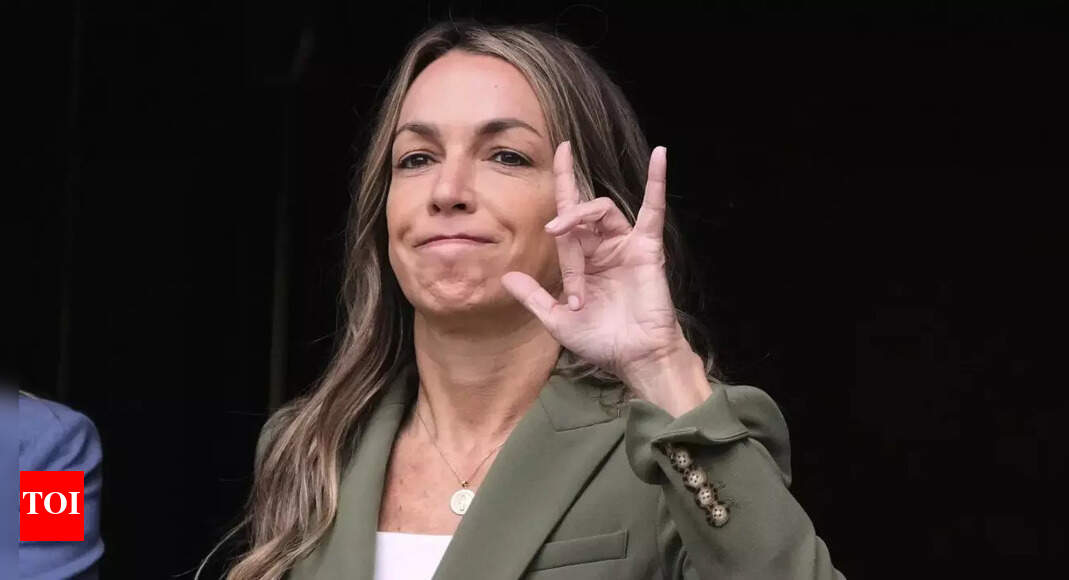

Markets will be closely following ECB President Christine Lagarde's post-announcement press conference amid uncertainty surrounding newly inaugurated U.S. President Donald Trump's policies.

Investors are keen to gauge how comfortable the ECB is with diverging from the U.S. Federal Reserve in terms of monetary policy and prospective relaxation. The Fed on Wednesday left interest rates unchanged, in line with expectations. Markets are overall pricing in fewer interest rate cuts from the Fed than from the ECB this year.

German economy shrinks by more than expected in fourth quarter

Germany's economy contracted by 0.2% in the fourth quarter, preliminary data from German statistics agency Destatis showed Thursday, compared with a 0.1% shrink expected by a Reuters poll.

The figure is adjusted for price, calendar and seasonal variations. In the previous quarter Germany's economy had expanded by 0.1%.

Household and government consumption expenditures increased, but exports were "significantly lower" than in the previous quarter, Destatis said.

"After a year marked by economic and structural challenges, the German economy thus ended 2024 in negative territory," it added.

— Sophie Kiderlin

French economy retreats in fourth quarter

Divergence between the ECB and the U.S. Fed

There will be plenty of questions for European Central Bank President Christine Lagarde in her post-announcement press conference on Thursday — including how the ECB views its divergence from the U.S. Federal Reserve, when it comes to their respective monetary policy easing cycles.

The ECB has so far cut interest rates four times, trimming by a quarter-percentage point on each occasion. The bank is set to announce its fifth trim on Thursday, with markets pricing in another three trims throughout the year.

The Fed meanwhile cut rates three times in 2024, including a bigger 50-basis-point reduction. It left rates unchanged when its meeting concluded on Wednesday, and fewer cuts are expected this year from the Fed compared to the ECB — likely just one or two.

Speaking to CNBC last week, Lagarde acknowledged the divergence, pointing to different economic environments in the euro area, compared to the U.S.

The euro area has been sluggish on the growth front, with some key economies like Germany and France in stagnation territory. The U.S. economy has meanwhile continued to grow at a solid pace.

— Sophie Kiderlin

European Central Bank expected to cut rates again with Trump threat and U.S. divergence in focus

The European Central Bank is widely expected to kick off its 2025 meetings with another interest rate cut on Thursday, as traders aim to gauge how far the central bank is willing to diverge from a stalled Federal Reserve.

Money markets on Wednesday were pricing in that the euro zone's central bank will cut by at least a quarter-percentage point. That would take the deposit facility, its key rate, to 2.75% marking its fifth trim since it began easing monetary policy in June 2024.

Read CNBC's full preview of Thursday's ECB decision here.

— Jenni Reid

4 months ago

84

4 months ago

84

English (US)

English (US)