Euro zone inflation risks tilted to downside, Belgium's Wunsch says

Risks to inflation and growth in the euro area are now tilted to the downside, Belgian central bank chief Pierre Wunsch told CNBC's Annette Weisbach at the European Central Bank's annual forum in Sintra.

"There is a broad consensus that we are very close to [the ECB's 2% inflation] target now, the job is mostly done," Wunsch said.

Pierre Wunsch, governor of the National Bank of Belgium, at ECB And Its Watchers conference in Frankfurt, Germany, on Wednesday, March 22, 2023.

Bloomberg | Bloomberg | Getty Images

"We've had two years of relatively slow growth in Europe, we're waiting for this recovery but of course with the uncertainty it might be again delayed a little bit, although the economy is resilient."

"So if anything, if we have to move more it probably will be to the downside, a further cut. I'm not pleading for one but I think if there is any discussion it's more in that direction."

The ECB will be monitoring economic data in the coming months to see if euro zone growth, particularly in production, improves — and may need to be "a bit more supportive" if it doesn't, he said.

The central bank cut interest rates to 2% in June, after inflation in the 20-nation bloc eased to 1.9%.

— Jenni Reid

Good morning from London, here are the opening calls

General view of the City of London skyline, the capital's financial district, in October.

Sopa Images | Lightrocket | Getty Images

Welcome to CNBC's live blog covering all the action in European financial markets on Tuesday, as well as the latest regional and global business news, data and earnings.

Futures data from IG suggests a generally positive start for European markets, with London's FTSE looking set to open unchanged at 8,774, Germany's DAX up 0.2% at 23,955, France's CAC 40 up a notch at 7,679 and Italy's FTSE MIB up slightly at 39,865.

The generally positive start for Europe comes as global investors begin to assess the trade talks and the tariff landscape as U.S. President Donald Trump's 90-day reprieve from higher import duties is set to expire next week.

Asia-Pacific markets traded mixed overnight as investors assessed the record gains on Wall Street and the prospects for trade deals, while U.S. equity futures were little changed early Tuesday after the S&P 500 notched another record to close out a stunning quarter.

U.S. Treasury Secretary Scott Bessent said Monday that there are "countries that are negotiating in good faith." However, he added that tariffs could still "spring back" to the levels announced on April 2 "if we can't get across the line because they are being recalcitrant."

Canada walked back its digital services tax in an attempt to facilitate trade negotiations with the United States. Ottawa's move to rescind the new levy comes after President Donald Trump said on Friday that he would be "terminating ALL discussions on Trade with Canada."

— Holly Ellyatt

What to look out for Tuesday

A Tante Enso store in Wörlitz, Germany.

Picture Alliance | Picture Alliance | Getty Images

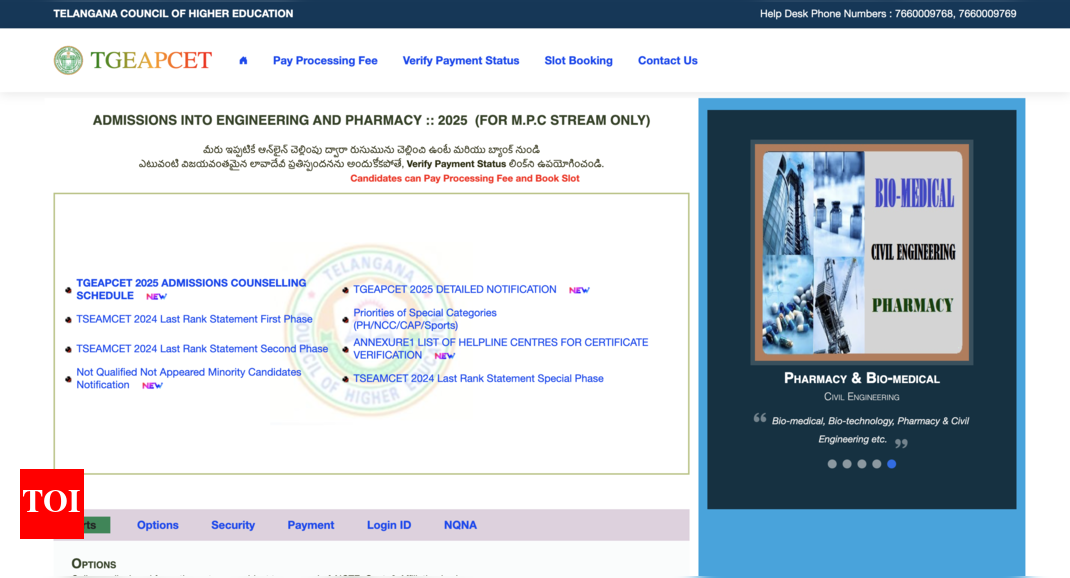

The big data release in Europe on Tuesday is the latest preliminary inflation data from the euro zone. Analysts expect the rate to have hit 2% in the year to June, which would be in line with the European Central Bank's target.

Earnings are set to come from Sodexo and Sainsbury's. Other data releases include German unemployment figures and U.K. Nationwide house prices data.

CNBC continues coverage of the ECB's forum in Sintra, Portugal, where central bankers have gathered this week.

— Holly Ellyatt

7 hours ago

34

7 hours ago

34

English (US)

English (US)