Traders work at the New York Stock Exchange on Jan. 29, 2025.

NYSE

U.S. stock futures hovered the flatline Wednesday night as Wall Street digested recent quarterly results from a slew of megacap tech companies. Investors are also coming off a losing session after the Federal Reserve held steady on rates.

S&P 500 futures and futures tied to the Dow Jones Industrial Average were little changed. Nasdaq 100 futures advanced 0.1%.

In extended trading, shares of Meta Platforms and Tesla gained nearly 2% and 4%, respectively, while Microsoft shares dipped 5% after the companies reported earnings. Both Meta and Microsoft beat on the top and bottom lines, but Tesla missed expectations.

Other "Magnificent Seven" names are set to report in the coming days, with Apple's results being due for a Thursday release. Amazon will soon follow suit, as the megacap tech company reports next week..

Meanwhile, Nvidia fell more than 1% after hours. It's been a difficult week for Nvidia. Shares are off 13% week to date, sliding on the heels of developments from Chinese artificial intelligence startup DeepSeek. The company's emergence fanned concerns regarding AI spending and U.S. dominance in the space.

On Wednesday, all three major averages ended the session lower. The declines come after the Fed paused its interest rate-cutting campaign, leaving its borrowing rate unchanged in a range between 4.25% and 4.5%. In their post-meeting statement, policymakers noted that inflation remains "somewhat elevated."

"The implication is that we're on hold until the inflation rate goes down, and unfortunately it's probably not going to go down very much in the several months ahead, so I wouldn't be looking for rate cuts at the next meeting," Jeffrey Gundlach, DoubleLine Capital CEO, said Wednesday on CNBC's "Closing Bell."

"We have a relatively stable place where we're standing, and it kind of supports the fact that the market is in a calm position right now, and so is [Jerome] Powell apparently," he said.

On the economic data front, the fourth-quarter gross domestic product reading is due on Thursday, and weekly jobless claims are out in the morning. Investors are also looking ahead to Friday's personal consumption expenditures price index report for December.

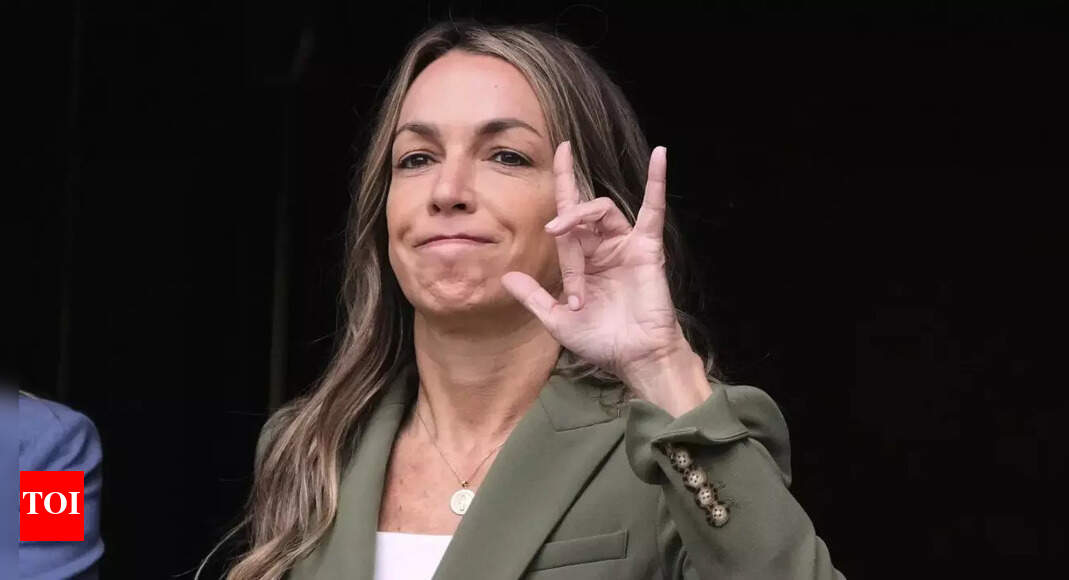

Tesla shares could have 'more to go' following post-earnings rise, Deepwater's Gene Munster says

Shares of Tesla rose 4% in extended trading on Wednesday despite its fourth-quarter earnings and revenue missing Wall Street's expectations, and Gene Munster of Deepwater Asset Management believes there could be more gains ahead for the stock.

"Ultimately, I think that [Tesla's] numbers are pretty choppy," the managing partner said on CNBC's "Fast Money" following the automaker's results. "It's just hard to … see why it's up right now. I think it's basically confirmation that people think that this has more to go."

Tesla reported adjusted earnings of 73 cents per share on $25.71 billion in revenue for the period. That's below the consensus estimate of 76 cents per share and $27.27 billion in revenue, per LSEG.

TSLA, 1-day

The stock is on pace to close out the first month of 2025 in negative territory, as it's seen month-to-date losses of more than 3%. It is also on track to underperform the broader market this week, with shares dropping more than 4% week to date.

— Sean Conlon, Lora Kolodny

Meta Platforms, Tesla among the names making moves after hours

Check out the stocks making big moves in extended trading:

- Meta Platforms — Shares rose about 5% after the company beat on the top and bottom lines. For the fourth quarter, Meta Platforms earned $8.02 per share on revenue of $48.39 billion, above the consensus estimate of $6.77 per share in earnings and $47.04 billion in revenue, according to LSEG. Separately, The Wall Street Journal, citing people familiar with the matter, reported that President Donald Trump has signed settlement papers that would require the company to pay around $25 million in regards to a 2021 lawsuit.

- Microsoft — Shares of the software giant slid about 2%. Microsoft's Azure cloud computing services saw growth of 31% in the fiscal second quarter, narrowly missing the consensus estimate for 31.1%, according to StreetAccount. Top- and bottom-line results surpassed Wall Street's estimates, however.

- Tesla — Shares of the electric vehicle manufacturer rose more than 2% even after Tesla's fourth-quarter results missed the mark. The company posted adjusted earnings of 73 cents per share on revenue of $25.71 billion. Analysts surveyed by LSEG were looking for 76 cents in earnings per share and $27.27 billion in revenue.

Read here for the full list.

— Sean Conlon

4 months ago

2090

4 months ago

2090

English (US)

English (US)