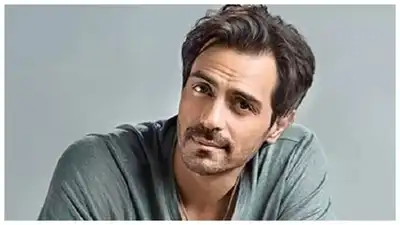

Arjun Rampal secured relief from the Bombay High Court, which overturned a non-bailable warrant issued in a 2019 tax evasion case. The court criticized the magistrate's order as lacking proper reasoning, especially considering the alleged offense is bailable. Rampal's lawyer asserts that the full tax amount was paid, albeit delayed, dismissing allegations of tax evasion.

Arjun Rampal has received relief from the Bombay High Court, which quashed a non-bailable warrant issued against him in a 2019 tax evasion case. The court slammed the local magistrate’s order as “mechanical and cryptic,” with Vacation Judge Justice Advait Sethna noting on May 16 that it was “contrary to law” and issued without proper consideration.NBW Challenged Over Procedural LapsesAccording to a report published in News18, Rampal had challenged the magistrate’s April 9 order that issued a non-bailable warrant against him in a case filed by the Income Tax Department under Section 276C(2) of the Income Tax Act — a provision that deals with willful attempts to evade tax payments, penalties, or interest.In his plea, Rampal argued that his advocate had requested an exemption from appearance, which the magistrate denied before issuing the NBW.HC Points to Bailable Nature of OffenceThe Bombay High Court observed that the alleged offence against Arjun Rampal is bailable and carries a maximum sentence of three years, making the issuance of a non-bailable warrant inappropriate. Justice Advait Sethna criticised the magistrate’s order as “mechanical” and “cryptic,” noting it lacked any reasoning or application of mind. The court further pointed out that issuing an NBW in a bailable offence, especially when Rampal’s advocate was present in court, was prejudicial to the actor.

Arjun Rampal has also challenged the magistrate’s notice issued in December 2019 in connection with the case. The Bombay High Court has scheduled the next hearing for June 16.No Evasion, Just Delayed Payment, Says Rampal’s Lawyer

Rampal’s advocate, Swapnil Ambure, argued that the full tax amount for the financial year 2016–17 had been paid, though delayed, and maintained there was no tax evasion as alleged by the department. He further contended that issuing a non-bailable warrant went against Supreme Court rulings, which discourage such action in similar cases.

8 hours ago

35

8 hours ago

35

English (US)

English (US)